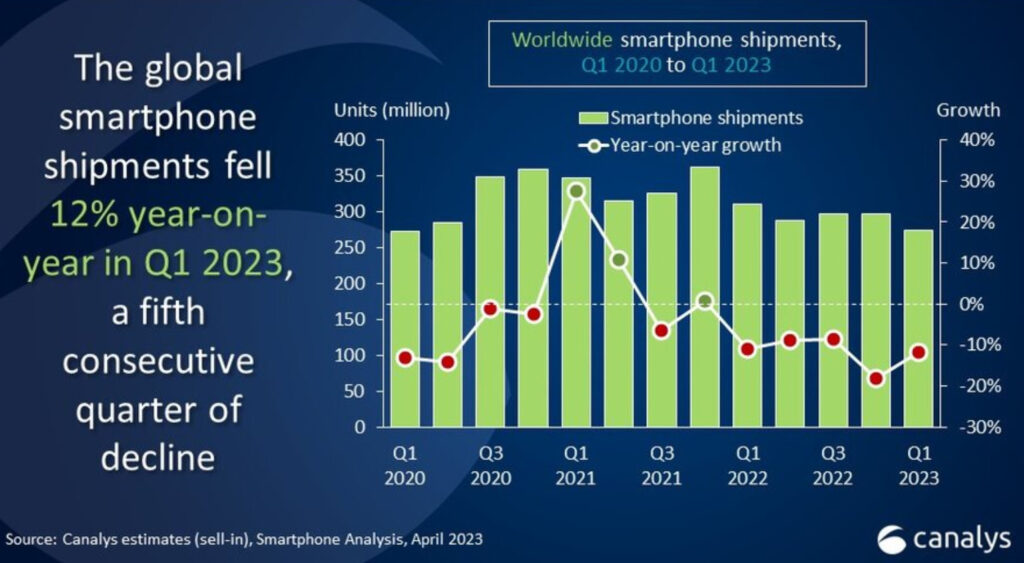

The global smartphone market experienced a 12% decline in shipments during Q1 2023, marking the fifth consecutive quarter of shrinkage. However, recent analyst data suggests that the market may be stabilizing. Interestingly, new data points to India as a significant contributor to the decline, with Q1 smartphone shipments in the country falling by 20% year-on-year to 30.6 million.

Challenging Macroeconomic Climate Impacts Smartphone Market

The overall unfavorable macroeconomic climate continues to hinder the market’s recovery. Vendors are facing difficulties in investments and operations across various markets, though specific markets were not mentioned in the Canalys report. The slow demand in India’s smartphone market can be attributed to the challenging economic situation.

Despite the decline, major brands are investing heavily in India’s market, focusing on retail, manufacturing, local sourcing, and R&D to secure long-term positions in the promising region.

Growth Potential in India’s Premium Smartphone Segment

While India’s mass market is moving slowly and expected to continue its sluggish pace throughout 2023, Canalys analyst Sanyam Chaurasia predicts that the premium segment is poised for growth, boosting the average selling price in the overall market. As disposable incomes rise, consumers are becoming more willing to spend on premium devices.

Global Smartphone Market: Signs of Recovery Amid Decline

Globally, consumer demand remains slow despite vendors’ price cuts and heavy promotions, particularly in the low-end segment. High inflation is affecting consumer confidence and spending, leading to low levels of sell-in from vendors and cautious production.

However, Canalys analyst Toby Zhu notes some signs of moderation in the continued decline, including improvements in demand for certain smartphones and price brackets, as well as increased activity in production planning and component ordering from some vendors.

Smartphone Industry Inventories Expected to Reach Healthy Levels by Q2

Canalys believes that smartphone industry inventories could reach a relatively healthy level by the end of Q2. Although it is too early to predict the overall recovery of consumer demand, the sell-in volume of the global smartphone market is expected to improve due to inventory reduction in the upcoming quarters.

5G and Foldable Phones: New Driving Forces in the Industry

The growing popularity of 5G and foldable phones is cited as the new driving force in the industry. In terms of vendors, Samsung managed a quarter-on-quarter recovery, putting it back in the number one spot ahead of Apple with a 22% market share. Apple’s market share stands at 21%, with solid demand for its iPhone 14 Pro series in Q1.

New Product Launches Boost Xiaomi, Oppo, and Vivo

New product launches towards the end of the quarter helped Xiaomi maintain its number three position with an 11% market share, followed by Oppo and Vivo. In India, Oppo edged past Vivo to take the top spot for the first time, while Samsung continued to lead the market.

Q1 Smartphone Numbers: Not Great, but Signs of Growth Emerge

Although the Q1 numbers for the smartphone market don’t look promising, they aren’t entirely unexpected. There are, however, signs of growth to anticipate in the future.

Leave a Comment

Your email address will not be published. Required fields are marked with *